Getting your loan application rejected is one of the most frustrating experiences—whether you need funds for personal emergencies or business growth. In Malaysia, over 40% of loan applications face rejection, leaving many borrowers confused and discouraged.

As a financial consultant who has helped hundreds of Malaysian SMEs and individuals navigate the lending landscape, I’ve seen the same rejection patterns repeatedly. The good news? Most rejections are preventable once you understand what banks actually look for.

This comprehensive guide reveals the top reasons why banks reject personal and business loan applications in Malaysia, and more importantly, provides actionable strategies to dramatically improve your approval chances.

Estimated Reading Time: 12–15 minutes

Common Reasons Why Banks Reject Your Application

Understanding rejection reasons is the first step toward building a stronger application. Here are the most frequent causes I encounter:

1. Poor Credit History (Personal & Business Impact)

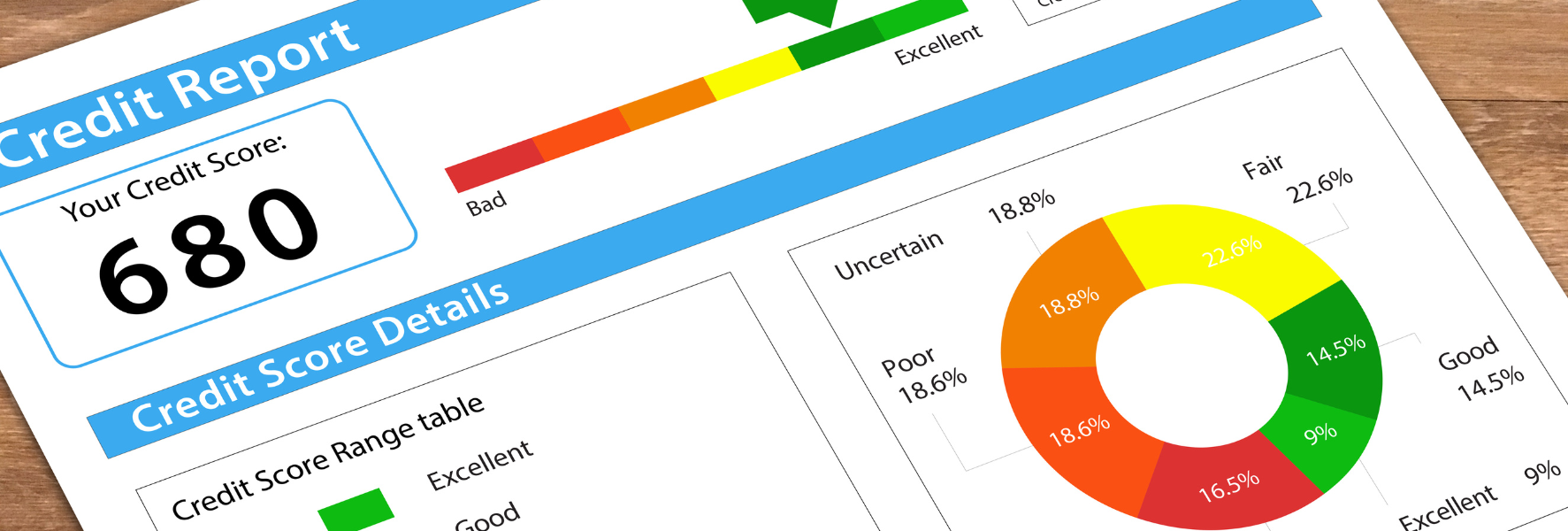

Your credit history is the foundation of any loan decision. Banks scrutinize both personal and business credit records through CCRIS (Central Credit Reference Information System) and CTOS reports.

Common credit issues include:

- Late payment history on existing loans or credit cards

- Previous defaults or bankruptcy records

- High credit utilization ratios

- Multiple recent credit inquiries

Key insight: Even for business loans, banks examine the personal credit history of business owners and guarantors. A poor personal credit score can sink your business loan application.

2. Insufficient Income vs. Loan Amount

Banks follow strict debt-service ratio guidelines to ensure you can comfortably repay the loan.

For personal loans:

- Total monthly commitments should not exceed 60% of gross income

- Unstable or insufficient income relative to requested amount

- Recent salary reductions or job changes

For business loans:

- Weak or inconsistent cash flow patterns

- Revenue that doesn’t support the requested loan amount

- Seasonal businesses without adequate cash reserves

3. Incomplete or Inaccurate Documentation

Poor documentation is a surprisingly common rejection reason that’s entirely avoidable.

Documentation issues include:

- Missing required documents (payslips, bank statements, audited accounts)

- Inconsistent information across different forms

- Outdated or expired documents

- Poor quality photocopies or unclear scanned documents

4. High Existing Debt Commitments

Banks are wary of overleveraged borrowers who may struggle with additional repayments.

Personal loan concerns:

- Multiple existing personal loans or credit card debts

- High housing loan commitments

- Guarantor obligations for other loans

Business loan concerns:

- Multiple business loans with different banks

- High supplier credit or trade financing

- Excessive overdraft usage

5. Lack of Security or Collateral

For secured loans, banks need adequate collateral to mitigate their risk.

Common collateral issues:

- Insufficient property value or unclear ownership

- Properties with legal issues or poor marketability

- Lack of personal guarantees for business loans

- Inadequate business assets for asset-based financing

6. Employment and Business Stability Issues

Banks prefer borrowers with stable, predictable income sources.

Employment red flags:

- Frequent job changes or contract-based employment

- Self-employed individuals without sufficient income documentation

- Employment in declining industries

- Probationary employment status

Business stability concerns:

- New businesses (less than 2 years operating history)

- Seasonal or cyclical business models

- Industries facing regulatory challenges

- Businesses heavily dependent on single customers or suppliers

7. Age and Retirement Concerns

Age affects loan tenure and repayment capacity in banks’ risk calculations.

Age-related issues:

- Too young (under 21) for certain loan products

- Nearing retirement age with limited repayment years

- Business owners without clear succession planning

- Insufficient working years left to complete loan tenure

8. Unclear or High-Risk Loan Purpose

Banks scrutinize how you intend to use the borrowed funds.

Problematic loan purposes:

- Debt consolidation without addressing underlying spending issues

- Speculative investments or gambling

- Vague business expansion plans without clear ROI

- Personal loans for business use (or vice versa)

9. Industry Risk and Market Conditions

Certain industries face higher scrutiny due to inherent risks or market conditions.

High-risk industries include:

- Food & beverage (high failure rates)

- Construction (project-based, cyclical)

- Retail (facing e-commerce disruption)

- Oil & gas (commodity price volatility)

- Tourism (post-pandemic recovery concerns)

10. Weak Management Team or Key Person Risk

For business loans, banks evaluate the management team’s capability and experience.

Management concerns:

- Lack of relevant industry experience

- Over-dependence on single key person (usually the owner)

- Poor track record in previous business ventures

- No succession planning or management depth

11. Regulatory and Compliance Red Flags

Banks must comply with strict regulatory requirements and avoid problematic borrowers.

Compliance issues:

- Outstanding tax obligations or late filings

- Missing business licenses or regulatory approvals

- Ongoing litigation or legal disputes

- Anti-money laundering (AML) concerns

12. Poor Banking Relationship History

Your relationship with the bank affects their willingness to lend.

Relationship red flags:

- History of bounced cheques or overdraft abuse

- Previous loan defaults with the same banking group

- Irregular account conduct or suspicious transactions

- No existing relationship or account history with the bank

Understanding Bank Lending Criteria

To improve your approval chances, you need to understand how banks evaluate loan applications.

The “5Cs” of Credit Assessment

Malaysian banks use this traditional framework to evaluate all loan applications:

- Character

- Personal and business integrity

- Credit history and payment behavior

- Reputation in the industry or community

- Capacity

- Ability to repay based on income or cash flow

- Debt-service ratios and financial stability

- Management capability for business loans

- Capital

- Owner’s financial contribution or equity stake

- Available liquid assets or reserves

- Financial strength and net worth

- Collateral

- Security offered to back the loan

- Quality and marketability of assets

- Legal clarity of ownership

- Conditions

- Overall economic environment

- Industry outlook and market conditions

- Specific loan terms and structure

What to Do After Rejection

Rejection isn’t the end of your financing journey—it’s valuable feedback for improvement.

Immediate Steps

- Request Specific Feedback

- Ask the bank for detailed rejection reasons

- Understand which criteria you failed to meet

- Get clarity on what improvements would help

- Don’t Apply Elsewhere Immediately

- Multiple rejections can damage your credit profile

- Address the root causes before trying other banks

- Allow time for any credit inquiries to settle

- Analyze and Plan Improvements

- Create a specific action plan to address rejection reasons

- Set realistic timelines for improvements

- Consider professional assistance if needed

Conclusion

Understanding why banks reject loan applications is crucial for any Malaysian borrower seeking financing. The reasons range from poor credit history and insufficient documentation to industry risks and economic conditions.

The key to success lies in preparation, transparency, and strategic application. By addressing potential issues proactively, choosing the right bank and product, and presenting a strong case, you can significantly improve your approval chances.

Remember, rejection is not a reflection of your worth or business potential—it’s simply feedback on your current financial profile and application quality. Use this information to strengthen your position and approach lending with confidence.

Whether you’re seeking personal financing for important life goals or business funding for growth opportunities, the right preparation and strategy can turn rejection into approval.

Still Getting Rejected? We Can Help

If your loan applications keep getting rejected despite following these tips, you’re not alone. Many Malaysian businesses and individuals struggle with complex bank requirements and ever-changing lending criteria.

Aefinansure specializes in helping clients who have faced multiple loan rejections. Our experienced team knows exactly what banks look for and can guide you through the entire application process—from strengthening your financial profile to choosing the right lender for your situation.

Don’t let another rejection discourage you from achieving your financial goals.

Professional loan application assistance • Higher approval rates • Personalized guidance