Overview

Personal loans are one of the most commonly used financing options in Malaysia, offering flexibility for everything from emergencies and debt consolidations to education, renovation, and medical expenses. With so many lenders and loan types available, we’re breaking down each and every single type of personal loans available in Malaysia, explaining how each works, who they’re suited for, and what to consider before applying.

A personal loan is a form of financing offered by banks, corporations, or government agencies. They can be either unsecured (no collateral required) or secured (backed by collateral). In Malaysia, personal loans are commonly used for debt consolidation, emergencies, big purchases, medical expenses, education or even home renovation.

There are multiple options available, and it can be overwhelming if you don’t know where to start, which is why understanding the different types of personal loans is important before applying.

Bank Personal Loans (Conventional & Islamic)

Bank personal loans are among the most common financing options in Malaysia, offered by major banks such as Maybank, CIMB, RHB, Public Bank, and HSBC.

Conventional Personal Loans

- Interest-based financing with fixed or variable interest rates

- Monthly repayments spread over a fixed tenure

Islamic Personal Financing (Personal Financing-i)

- Shariah-compliant financing based on contracts like tawarruq or bai’ al-inah

- Profit rate is fixed and disclosed upfront

These bank loans usually come with a few common features that borrowers should know before applying:

- Loan amount: RM1,000 – RM250,000

- Tenure: Up to 10 years

- Collateral: Not required (unsecured)

Bank loans offer structured repayment plans and are widely trusted, making them a reliable option for emergencies, major purchases, or debt consolidation.

Cooperative (Koperasi) Loans

Cooperation loans, also known as Pinjaman Koperasi, are popular among government servants and GLC employees. They are offered by registered cooperatives such as Koperasi Tentera and Yayasan Ihsan Rakyat.

If you want to make a repayment for this, it’s typically done through salary deductions via the ANGKASA system, making them easier to manage.

Here are some of the key features:

- Easier approval compared to banks

- Slightly higher rates, but consistent deductions

- Loan amount: RM5,000 – RM200,000

Cooperative loans are a practical option for those seeking accessible financing with manageable repayment plans.

Licensed Moneylender Loans

These loans are offered by companies licensed under KPKT (Ministry of Housing and Local Government). These loans are ideal for borrowers who need quick access to cash or may not meet the strict requirements of traditional banks.

Here are the key features:

- Faster approval and flexible criteria

- Higher interest or profit rates than banks

- Loan amount: RM1,000 – RM20,000

- Requires strong repayment discipline

While these loans offer convenience and speed, borrowers should be cautious and ensure they can manage repayments responsibly.

Government Agency Loans

Government agency loans are designed for specific groups, such as students, civil servants, or small business owners. These loans are generally easier to obtain and often come with lower interest or profit rates.

Some examples include:

- TEKUN National – for micro-entrepreneurs

- MARA Education Loans – for students

- LPPSA – for civil servants’ housing loans

- GGSM – for micro businesses

And these are the key features:

- Low or subsidised rates

- Eligibility based on occupation, income, or community

Government agency loans are a great option for targeted support, helping eligible borrowers access financing with more favourable terms.

Islamic Cooperative & Islamic Micro-Financing

These are Shariah-compliant loans designed to help more people access financing, especially those in the B40 group who might not have collateral.

For example:

- Amanah Ikhtiar Malaysia (AIM) – group-based loans for women entrepreneurs

- Yayasan Ikhlas – microloans for small business owners in rural areas

- Bank Rakyat Micro-Financing – Shariah-compliant loans for low-income entrepreneurs.

Here’s what you can expect:

- Loan amounts are typically smaller, ranging from RM500 to RM50,000

- Often guaranteed by a group rather than requiring collateral

These loans focus on financial inclusion, helping underserved communities gain access to essential funding for business or personal growth.

Credit Card Cash Advance / Balance Transfer

These are technically not personal loans, but some people do use credit card cash advance or balance transfer as short-term financial tools. Let’s look at the two options.

| Cash Advance | Balance Transfer |

| Instant cash from credit cards | Transfer outstanding card balances |

| High interest if not repaid quickly | Often comes with 0% of low interest for a fixed period |

And these are the key features:

- Fast access to funds

- High risk of debt accumulation if poorly managed

Used wisely, these options can provide short-term financial relief, but careful planning is essential to avoid excessive interest or long-term debt.

Digital & Fintech Personal Loans

Digital lenders and e-wallet providers such as AEON Credit, BigPay Later, Boost Credit, and Grab PayLater offer quick, small-ticket financing.

Here’s what you need to know about them:

- Loan amount ranging from RM500 to RM10,000

- Minimal paperwork

- Fast or instant approval

- Higher effective interest or profit rates

These loans are ideal for small, short-term financing needs, but borrowers should manage repayments carefully to avoid high costs.

Specialised Personal Financing

Not all personal loans are meant for general use. Some financing options are designed for specific needs, making them more suitable, and sometimes more affordable, than taking a standard personal loan.

Education Loans

These types of loans are created to support students and families with tuition fees, living expenses, and education-related costs.

Common examples include:

- PTPTN – for higher education at local and selected overseas institutions

- MARA Education Loans – targeted at Bumiputra students

Key Features

- Lower interest or profit rates compared to general personal loans

- Longer repayment periods with flexible terms

- Repayment often starts after graduation, easing financial pressure during studies

Education loans are an effective way to invest in your future without overburdening your finances.

Medical Financing

On the other hand, there’s medical financing, which helps to cover hospital bills, surgeries, treatments, or major medical procedures that may not be fully covered by insurance.

Some banks and insurers offer:

- Medical-specific instalment plans

- Short-term financing with faster approval

- Preferential rates for panel hospitals

Medical financing is especially useful during unexpected medical emergencies, providing immediate access to funds when timing is critical.

Buy-Now-Pay-Later (BNPL) Instalments

Buy-Now-Pay-Later (BNPL) has become one of the most popular financing options in Malaysia, offered by companies like Shopee, ShopBack, Grab, Atome, and more.

BNPL allows consumers to split purchases into smaller instalments, often with 0% interest for short periods, making it convenient for managing short-term cash flow.

Important to note:

- Missed payments can affect your credit profile

- Late payments may incur additional fees

When used responsibly, BNPL is a convenient way to manage expenses, but it requires disciplined repayment to avoid financial pitfalls.

Comparison Table of Personal Loan Types

To help you quickly see the differences, here’s a handy comparison of the main personal loan options available in Malaysia. It includes details like typical loan amounts, interest or profit rates, eligibility, and approval speed, so you can make an informed choice at a glance.

| Loan Type | Typical Amount | Interest/Profit Rate | Eligibility | Speed of Approval |

| Bank Loan | RM1k – RM250k | 3% – 10% p.a. | Income-based | 3–7 days |

| Koperasi Loan | RM5k – RM200k | 4% – 8% p.a. | Gov/GLC staff | 7–14 days |

| Licensed Moneylender | RM1k – RM20k | 10% – 18% p.a. | All (with IC) | 1–2 days |

| Govt Agency Loan | RM1k – RM100k | Low/subsidised | Specific groups | 2–6 weeks |

| Digital/Fintech | RM500 – RM10k | 8% – 18% p.a. | Working adults | Instant–3 days |

This table helps you compare features side by side, making it easier to choose the loan that best fits your financial needs and repayment capacity.

How to Choose the Right Loan

Choosing the right personal loan isn’t just about getting quick cash, it’s about finding a loan that fits your needs, budget, and long-term financial health. Here’s what to keep in mind:

- Identify the purpose of the loan

Understanding why you need the loan helps narrow down your options.

- Emergency expenses: You might need fast approval or small-ticket loans from licensed moneylenders or digital lenders.

- Education or business financing: Consider government or cooperative loans with lower rates and structured repayment plans.

- Lifestyle or renovation projects: Banks or fintech platforms may offer promotional rates or flexible instalments.

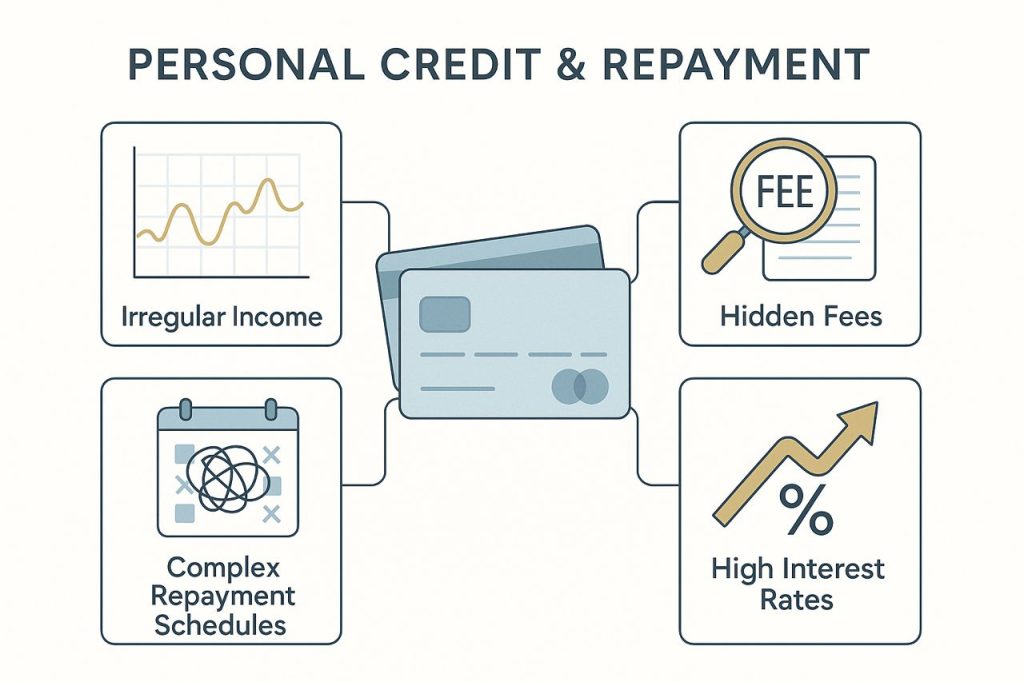

- Compare total interest or profit costs

When you’re considering a loan, don’t just look at the headline interest rates, you should also check for:

- Hidden fees or processing charges

- Late payment penalties

- Effective annual rate (EIR) to see the true cost of borrowing

A slightly higher rate with no hidden fees may be cheaper in the long run than a lower advertised rate with extra charges.

- Assess your repayment capacity

Before applying, make sure the monthly repayments fit comfortably within your budget.

- Avoid loans that take more than 30-40% of your monthly income.

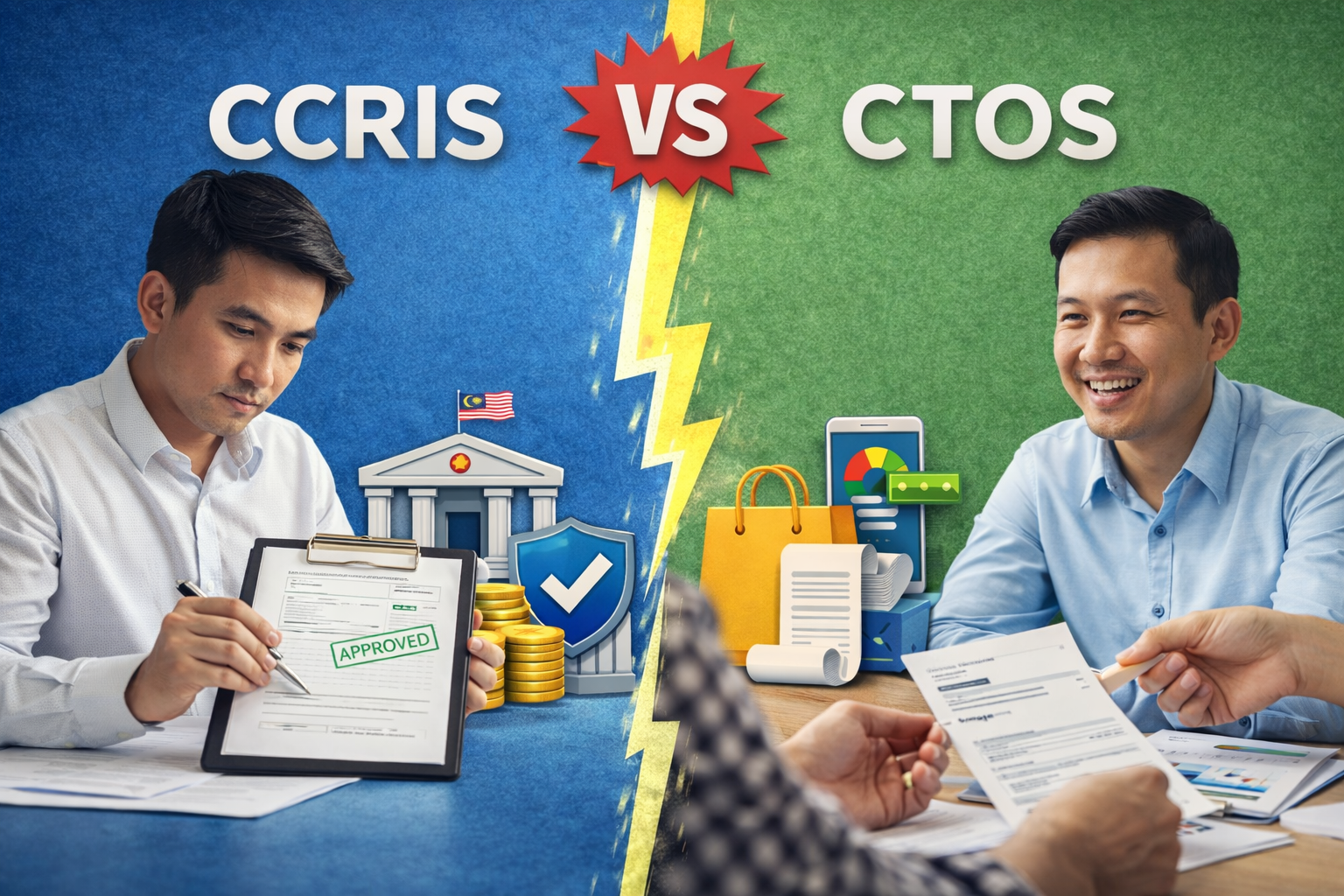

- Consider your existing obligations reflected in CCRIS and CTOS reports.

- Factor in possible changes in income or unexpected expenses.

- Check eligibility and lender credibility

It’s easy to fall for ineligible lenders, especially when you’re desperate for money. Before you consider applying for a loan, verify eligibility requirements such as age, income, and employment status before applying. You should also only borrow from licensed lenders such as banks, cooperatives, or registered digital platforms.

Be extra cautious of unlicensed moneylenders (“Ah Long”) who can charge exorbitant interest and threaten legal trouble.

Conclusion

The good news is that Malaysians have access to a wide range of personal loan options, each with its own benefits and risks. This is why choosing the right loan heavily depends on your financial needs, income stability, and repayment discipline.

Before applying for a loan, always review your CTOS and CCRIS reports to avoid rejection and ensure your credit is in good standing. We hope this article helps you make informed choices and stay financially secure in the long run.

Frequently Asked Questions

- What is the difference between secured and unsecured loans?

Secured loans require collateral, such as a house or vehicle, while unsecured loans rely solely on your income and creditworthiness.

- Can I apply for multiple personal loans at the same time?

Yes, but we wouldn’t advise it as it may affect approval chances and your CCRIS and CTOS records.

- Will taking a personal loan affect my CTOS/CCRIS record?

Yes. Repayment behaviour is reflected in CCRIS, while CTOS captures broader credit data, including legal and trade information.

- What’s the maximum tenure for personal loans in Malaysia?

Most personal loans range from 1 to 10 years, depending on the lender.

- Is it better to take a bank loan or koperasi loan?

It depends on eligibility, rates, and repayment method as each has its own advantages.

Sources:

- https://www.imoney.my/articles/types-of-personal-loans-in-malaysia

- https://ringgitplus.com/en/blog/personal-loans/different-types-of-personal-loans-in-malaysia.html

- https://www.bluebricks.com.my/types-personal-loans-malaysia/

- https://www.comparehero.my/articles/personal-loan-101

- https://blog.fundingsocieties.com.my/personal-loans-guide/

- https://www.cimb.com.my/en/personal/life-goals/save/when-should-you-consider-a-personal-loan.html

- https://ringgitplus.com/en/blog/personal-loans/how-to-choose-the-best-personal-loan-for-your-needs.html

- https://www.directlending.com.my/blog/what-is-koperasi-loan/

- https://www.imoney.my/articles/what-is-licensed-moneylender

- https://www.myra.com.my/library/government-loans/

- https://nzchambers.com/financing-by-co-operatives-in-malaysia-frequently-asked-questions

- https://www.bnm.gov.my/microfinance

- https://www.hlb.com.my/en/personal-banking/blog/hlb-understanding-cash-advances-on-your-credit-card-in-malaysia.html

- https://fintechnews.my/48009/digital-banking-news-malaysia/list-of-digital-banks-in-malaysia-2025/

- https://eduadvisor.my/articles/education-loans-to-help-fund-your-higher-education

- https://protecthealth.com.my/

- https://www.investopedia.com/buy-now-pay-later-5182291