Overview

Your CTOS score plays an important role in how banks, lenders, employers, and even landlords assess your financial reliability. It gives them a quick review of your creditworthiness and helps them evaluate the level of risk involved. Here, in this article, we’ll explain what a CTOS score is, how it’s calculated and why it matters.

——————————————————————————————————

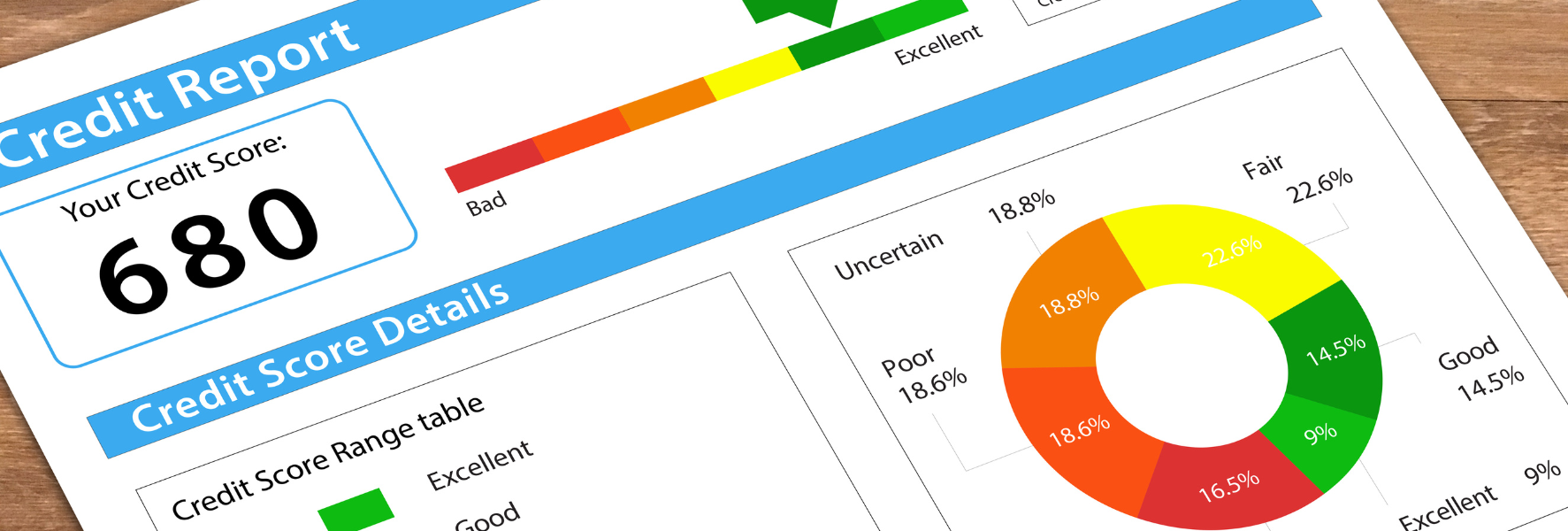

A CTOS score is a numerical representation of your creditworthiness, typically ranging from 300 to 850. The higher your score, the stronger your credit health.

This score is widely used by banks, credit card issuers, employers, and landlords to evaluate your financial reliability, helping them make informed decisions about loans, credit, and even tenancy or employment applications.

Understanding the CTOS Score

Several factors can influence your CTOS Score, which reflects your overall creditworthiness:

- Repayment history: Timely payments can boost your score, while late or missed payments reduce it.

- Credit utilisation: High utilisation of available credit can negatively affect your score.

- Credit mix: A healthy balance between credit cards, hire purchase, and loans shows responsible credit behaviour.

- Legal and trade references: Court cases, bankruptcies, or trade disputes can lower your score.

- New credit applications: Multiple loan applications in a short period signal a higher risk for lenders.

Why Improving Your CTOS Score Matters

A higher CTOS Score can open doors to better financial opportunities and greater flexibility. Benefits include:

- Better chances of loan or credit card approval

- Lower interest rates offered by banks

- A positive impression for employers and landlords

- Greater financial flexibility and opportunities in the future

Maintaining a healthy CTOS Score is not just about loans; it’s about building a reliable financial profile that supports your long-term goals.

Practical Steps to Improve Your CTOS Score

Improving your CTOS Score is all about consistent financial habits and careful monitoring.

Here’s how you can strengthen your credit profile:

- Pay Bills and Loans on Time – Paying your bills on time is the single most important factor in maintaining a strong CTOS Score.

Tips: set automated payments, reminders or pay the minimum due if full payment isn’t possible

- Reduce Outstanding Debts – Focus on high-interest debts such as credit cards or personal loans. Avoid rolling balances unnecessarily, which can negatively impact your score.

- Keep Credit Utilisation Low – Aim to use less than 30% of your total credit limit. If you need to request a higher credit limit, use it responsibly, and don’t overspend.

- Avoid Too Many New Applications – Every credit application leaves a footprint. Applying to too many applications in a short time signals risk to lenders.

- Check and Correct Your CTOS Report – Access your report online and review for errors, outdated information, or duplicates. File disputes to CTOS for corrections when necessary.

- Resolve Legal or Trade Issues Promptly – If you have any legal cases, bankruptcy issues, or trade references that could negatively affect your score, settle them as soon as possible. Negotiate with creditors where possible.

- Build a Healthy Credit Mix – A combination of secured credit (housing loans, hire purchase) and unsecured credit (credit cards, personal loans) demonstrates financial responsibility. Avoid relying solely on one type of credit.

- Monitor Your Score Regularly – Subscribe to CTOS monitoring services to track progress and detect issues early, such as fraud or unauthorised loans.

Following these steps consistently can help you boost your CTOS Score, giving you better access to loans, lower interest rates, and stronger financial flexibility.

How Long Does It Take to See Improvements

The speed at which your CTOS Score improves depends on the steps you take to manage your credit responsibly.

- Short-term (3-6 months): On-time payments and lower utilisation can show immediate improvements

- Medium-term (6-12 months): Reducing debt and fewer new applications positively impact your score

- Long-term (1-2 years): A clean record and balanced credit portfolio create lasting improvement

Common Mistakes to Avoid

- Paying late even once

- Maxing out credit cards

- Ignoring errors in your report

- Closing old accounts unnecessarily (this shortens credit history length)

By avoiding these mistakes and following good credit habits, you can steadily strengthen your CTOS Score and improve your financial standing.

Conclusion

Now that you understand the importance of your CTOS Score and ways to improve it, it’s clear that enhancing your credit profile is a journey and that you can’t expect an overnight fix.

By monitoring your reports regularly, paying bills on time, and managing your debts responsibly, you can steadily build a strong CTOS Score. A healthier credit profile opens the door to better loan approvals, lower interest rates, and greater financial opportunities in the future.

Frequently Asked Questions

- What is considered a “good” CTOS Score in Malaysia

A score above 750 is considered good, while 650-749 is considered good, while 650-749 is seen as fair. Higher scores indicate stronger credit health.

- Does checking my own CTOS Score affect it?

No, checking your own score does not lower it. You can monitor your credit safely without any impact.

- Can I improve my score if I was previously blacklisted?

Yes! By consistently paying off debts and correcting any inaccuracies on your report, you can rebuild your CTOS Score over time. It’s not hopeless!

- How often should I check my CTOS Score?

It’s a good idea to check at least once or twice a year, or before applying for loans or credit.

- Do employers check CTOS Scores when hiring?

It depends. Some employers, particularly in banking and finance, may check CTOS for roles requiring financial trustworthiness, but it’s not a universal practice across all industries.

Sources:

- https://ctoscredit.com.my/learn/how-to-improve-your-ctos-score/

- https://ctoscredit.com.my/learn/improve-ctos-score

- https://ringgitplus.com/en/blog/sponsored/boosting-your-ctos-score-and-credit-health.html

- https://bigpaysupport.zendesk.com/hc/en-us/articles/36817147627661-How-can-I-improve-my-CTOS-Score

- https://ctoscredit.com.my/learn/how-a-good-ctos-score-can-increase-your-chances-of-loan-approval/

- https://www.propertyguru.com.my/property-guides/what-is-ctos-score-how-can-you-improve-it-16618

- https://www.aia.com.my/en/knowledge-hub/plan-well/what-is-credit-score-and-how-to-increase-it.html

- https://ctoscredit.com.my/learn/how-a-good-ctos-score-can-increase-your-chances-of-loan-approval/?srsltid=AfmBOopdT4ZIKLl3yP8-zQ60KIZ8FT0qiccny7PiYrRYI9iJVzUP7RDJ