Overview

Understanding your credit profile is essential when playing for loans, credit cards, or other financial facilities in Malaysia. There are two key systems that play a major role in how banks and lenders assess creditworthiness: CTOS and CCRIS. In this article, we’ll share what sets CTOS apart from CCRIS, explains how banks use each report, and shows you how to read them.

This guide will break down the key differences between CTOS and CCRIS, explain how banks and lenders use each report, and show you how to read and make sense of them.

What is CTOS?

CTOS is a private credit reporting agency regulated under the Credit Reporting Agencies Act 2010 (CRAA). It collects and compiles information from a variety of public and commercial sources to give lenders a broader view of an individual’s or business’s financial history.

Some of the main sources include:

- Legal cases and court records

- Bankruptcy and insolvency data

- Trade references and payment behaviour

- Company registrations and directorships

- Direct trade data from participating businesses

This combination of data helps banks, employers, landlords, and other institutions assess creditworthiness and financial reliability.

Unique Features of CTOS

What sets CTOS apart is how it empowers individuals to track and understand their own credit profile. Unlike traditional credit reports, CTOS gives users tools to actively monitor their financial standing and make informed decisions.

Key features include:

- CTOS Score: A numerical score that helps users quickly understand credit risk

- Real-time credit alerts: Notifications whenever there’s a change to your profile, such as a new credit application or legal record.

- Easy access: Anyone can purchase and monitor reports through the online platform, making it simple to stay on top of their credit health.

These features make CTOS not just a reporting system, but a practical tool for managing and improving creditworthiness.

Who Uses CTOS?

CTOS is widely used by various organisations to assess the creditworthiness of individuals and businesses. Some of the main users include:

- Banks and financial institutions

- Employers (mainly for background screening)

- SMEs assessing business partners

- Landlords and property agents

By providing a comprehensive view of credit and financial history, CTOS helps these organisations make informed, responsible decisions.

What is CCRIS?

CCRIS (Central Credit Reference Information System) is Malaysia’s official credit reporting system, managed by Bank Negara Malaysia (BNM). It collects information exclusively from licensed financial institutions to give lenders a clear picture of a borrower’s financial obligations.

Sources of CCRIS data include:

- Banks: personal and business loans, credit cards, mortgages

- Credit card issuers: card usage and repayment history

- Hire purchase providers: financing for vehicles and other goods

- Islamic financing institutions: Shariah-compliant loans and facilities

What does a CCRIS Report Show

A CCRIS report provides detailed information on:

- Outstanding loans and credit facilities

- Repayment history for the last 12 months

- Special Attention Accounts (loans under close monitoring)

This data helps financial institutions assess creditworthiness and manage lending risk effectively.

Who Uses CCRIS?

Like CTOS, CCRIS is mainly used by banks and licensed lenders to evaluate an individual’s or business’s creditworthiness. It helps them make informed decisions about:

- Loan applications: whether to approve or reject new loans

- Credit limits: determining the maximum credit or financing amount

- Risk exposure: assessing the likelihood of late payments or defaults

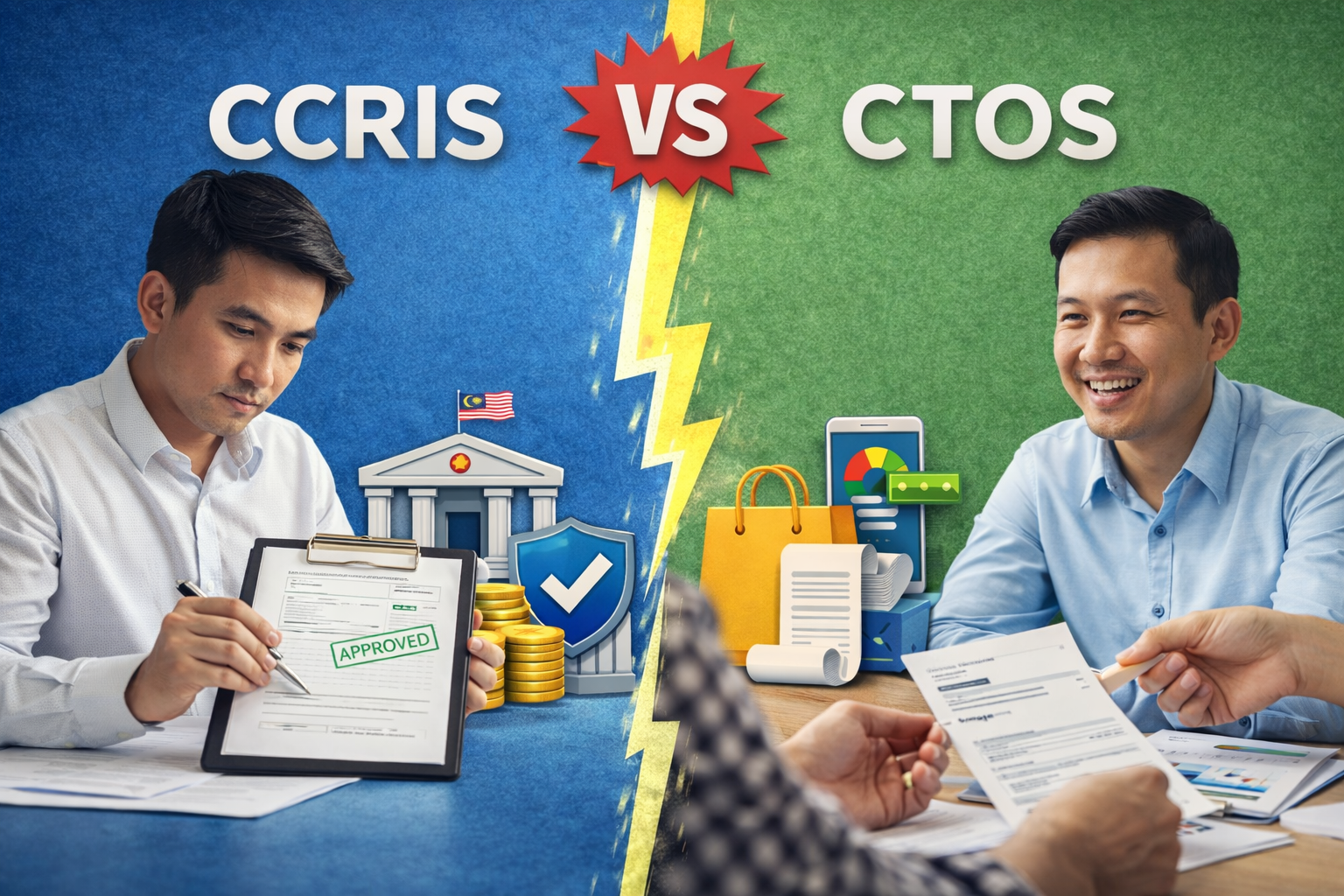

Key Differences between CTOS and CCRIS

| CTOS | CCRIS | |

| Ownership | Private company (CTOS Digital Bhd) | Bank Negara Malaysia |

| Data Sources | Legal casesTrade referencesCompany filingsCTOS Score | LoansCredit cardsHire purchase from banks |

| Accessibility | Individuals & businesses can purchase reports | Individuals can check via BNM’s eCCRIS portal |

| Scoring System | CTOS Score provided | No score |

| Frequency of Updates | Update constantly, depending on sources | Monthly updates from banks |

| Primary Use | Credit assessment, background checks | Official financial assessment by lenders |

How Lenders Use CTOS and CCRIS

Banks and lenders often review both CTOS and CCRIS reports to get a complete picture of a borrower’s financial profile.

- CCRIS shows your repayment behaviour and outstanding debt, giving lenders insight into your credit discipline.

- CTOS provides broader background information, including legal issues, trade disputes, and company affiliations.

- Credit scoring models often combine CTOS insights with CCRIS records to evaluate overall risk.

- Employers and landlords may rely heavily on CTOS for background checks and tenant screening.

By using both reports together, lenders can make more informed and responsible lending decisions.

Why Both Reports Matter for Malaysians

Both CTOS and CCRIS play important but slightly different roles in managing credit.

- CTOS helps individuals monitor and manage their own credit profile, giving clear insights and ongoing visibility into financial standing

- CCRIS is the official record that banks and licensed lenders rely on when assessing loan or credit applications

When used together, CTOS and CCRIS provide a complete picture of your creditworthiness, combining repayment behaviour with broader financial and background information. Understanding both reports can help you make smarter financial decisions and avoid surprises when applying for loans or credit.

When Should You Check CTOS vs CCRIS

| Scenario | Which Report to Check |

| Before applying for loans or credit cards | Both CTOS and CCRIS |

| After a loan rejection | CCRIS |

| Concerned about legal or trade issues | CTOS |

| Personal financial planning | CTOS |

Tips to Improve Your Credit Standing

Maintaining a good credit profile requires consistent attention and responsible financial habits. Here are some practical tips to help you improve your credit standing:

- Pay loans and credit cards on time

- Avoid legal disputes and settle outstanding obligations

- Monitor your CTOS Score regularly

- Maintain healthy credit utilisation

Following these steps can help you strengthen your creditworthiness, making it easier to access loans, credit cards, and other financial products in the future.

Conclusion

Now that you have a clear understanding of both CTOS and CCRIS, it’s clear that they are essential tools in Malaysia’s credit ecosystem. To reiterate, CCRIS reflects your official financial commitments, while CTOS provides a broader view of your overall credit profile, including legal and trade-related information.

By regularly reviewing both reports, you too can now take control of your own financial health, address issues early, and improve your chance of securing better financial opportunities. Staying informed is the first step toward smarter, more responsible borrowing.

Frequently Asked Questions (FAQ)

Is CTOS the same as CCRIS?

No. It’s common to use them interchangeably, but CTOS is a private credit reporting agency, while CCRIS is managed by Bank Negara Malaysia.

Does checking my own CTOS or CCRIS report lower my credit score?

No need to worry, self-checks do not affect your credit standing.

Can I remove negative records from CTOS or CCRIS?

Negative records cannot be removed unless they’re inaccurate. If you spot errors, you can request corrections with the proper supporting documents.

How often should I check my credit reports?

It’s a good idea to check at least once or twice a year, or before applying for loans or credit cards

Which report do banks trust more, CTOS or CCRIS?

Banks rely on both. CCRIS is mandatory for assessing loans, while CTOS provides additional context, such as legal issues or trade disputes, giving a fuller picture of your financial standing.

Is CTOS Score official?

The CTOS Score is an indicator of credit risk, not an official bank-issued score. However, it’s widely used by lenders to evaluate creditworthiness.

Sources:

- https://www.comparehero.my/articles/difference-between-ccris-ctos

- https://www.stashaway.my/r/complete-guide-ccris-ctos-malaysia-credit-reporting-system

- https://bigpayme.com/blog/everything-you-need-to-know-about-ccris-and-ctos-in-malaysia

- https://www.directlending.com.my/blog/infographic-ccris-ctos-difference/

- https://www.iproperty.com.my/guides/credit-report-faq-whats-ccris-and-how-is-it-different-from-ctos-19704

- https://www.propertyguru.com.my/property-guides/here-is-why-your-ccris-and-ctos-reports-matter-12339