You’re paying your bills on time. You’re keeping your finances in check. But do you actually know what your credit score is? This number may look randomly generated, but it has the power to shape your financial future. In fact, it can single-handedly determine your financial opportunities, like whether you get that home loan, credit card, or even job you’ve been eyeing.

Don’t worry, in this article, we’re going to break down everything you need to know about credit scores in Malaysia: the types of CTOS reports, how it works, how to check it, and how to read your credit report. Let’s go!

What is CTOS?

First things first, what exactly is CTOS? CTOS, or Credit Tip-Off Services, is Malaysia’s leading private credit reporting agency. They collect and compile information from public sources and government agencies to build comprehensive credit reports. These reports include important financial details like your credit score, payment history, legal records, and even business ownership. They help financial institutions and businesses decide if you’re eligible for loans, credit cards, or other financial products. Think of it like a report card for your finances, showing institutions whether you’re trustworthy with money.

These CTOS reports are crucial because they paint a picture of your financial reliability. If you have a healthy credit score, it opens up opportunities for better loan rates and higher credit limits because it shows you’re responsible with your finances. But if you have a poor CTOS score, it will be harder to get approvals.

Types of CTOS Reports

There are three types of CTOS reports you can choose from: MyCTOS Basic Report, MyCTOS Score Report, and CTOS SecureID.

| Types of CTOS Report | What It’s For | Price |

| MyCTOS Basic Report | Gives a simple overview of your credit history, including loans, credit cards, and legal records. Includes: Personal information (NRD)Directorship and business interest (SSM)Litigation and bankruptcy Trade referee listings (eTR)2 free MyCTOS Basic Reports a year | FREE |

| MyCTOS Score Report | Includes your credit score along with the basic report, showing your overall creditworthiness. Includes: Personal information (NRD)Directorship and business interest (SSM)Litigation and bankruptcy Trade referee listings (eTR)2 free MyCTOS Basic Reports a yearCTOS ScoreCCRIS Records (BNM)Access to rewards | RM27.90 per report (inclusive of SST) |

| CTOS SecureID | Helps verify your identity and monitors for any potential fraud risks linked to your personal information. Includes: Leaked personal info and data breach on the dark webNew credit application and account closuresChange of address and contact information4 MyCTOS Score reports yearlyMissed payment alertsFraud and takaful coverage | RM9.90 per month or RM99 per year |

How CTOS Collects & Processes Data

CTOS data is collected from official sources and businesses such as government agencies, courts, and banks.

It is then organised into a clear report with a credit score that reflects how well you manage your finances. This report helps banks, companies, and even you assess your financial reliability.

Where CTOS gets its data from:

- Legal notices in the newspaper

- Companies Commission of Malaysia (SSM)

- Government gazettes and publications

- Malaysian Department of Insolvency

- National Registration Department (JPN)

- Immigration Department of Malaysia

- Registrar of Societies (ROS)

- National Higher Education Fund Corporation (PTPTN)

How to check CTOS?

Here’s a step-by-step guide.

Step 1: Decide how to request it

Online – Via the MyCTOS website or mobile app.

Offline – Visit the nearest CTOS branch or submit a written request.

Step 2: Gather required documents

For individuals:

- NRIC (for Malaysians) or passport (for foreigners)

- Bank statement or utility bill (as proof of address)

For businesses:

- Business registration documents and the owner’s identification

Step 3: Choose your report type

Pick one of the three types mentioned above, depending on your needs.

Step 4: Submit your request

Online – Sign up for a MyCTOS account, select your report type, upload documents, pay fees (if any), and you’re done!

Offline – Bring your documents and payment to the nearest branch and submit in person.

Step 5: Wait for processing

Online – Usually ready within a few hours

Offline – Typically 1–3 days, depending on verification and report type

Step 6: Review your report

Check for errors or outdated information. If you find mistakes, submit a correction request to CTOS.

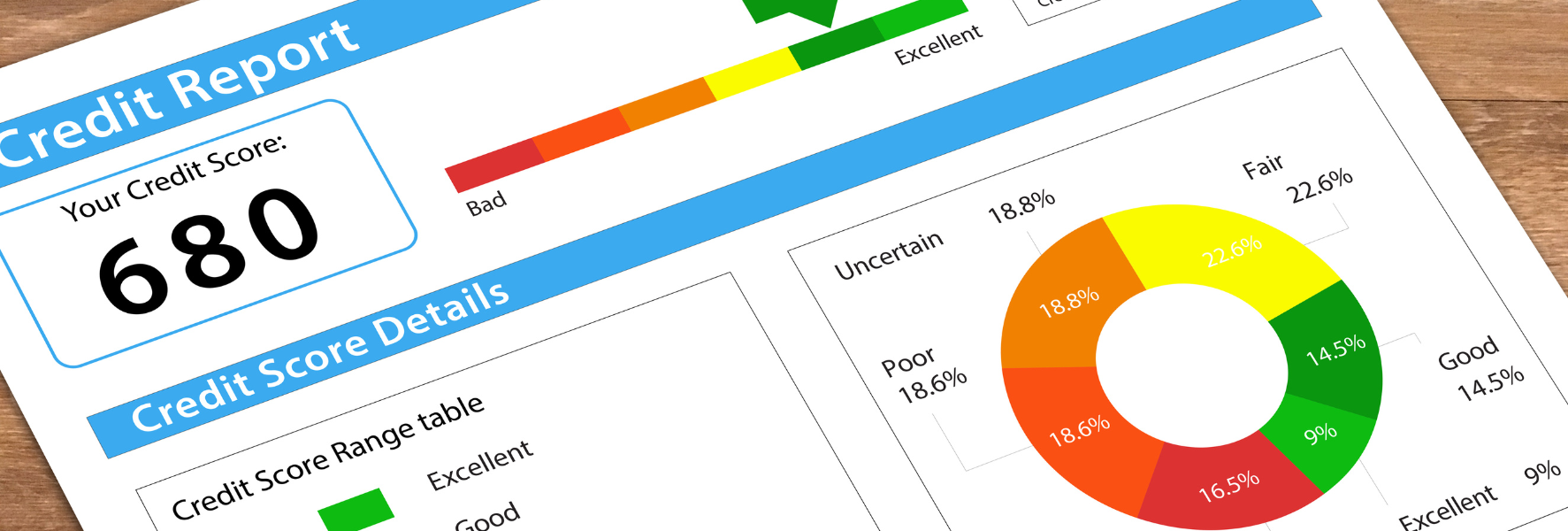

How to Read Your Credit Score

In order to read your credit score, note that CTOS scores range from 300 to 850. A higher score indicates stronger creditworthiness, which means a better chance of getting your loans or credit application approved.

Here’s a table to help you visualise it better

| Score | What It Means to Lenders |

| 744-850 | Excellent! You’re viewed very favourable by lenders. |

| 718-743 | Very Good! You’re viewed as a prime customer. |

| 697-717 | Good! You’re above average and viable for new credit. |

| 651-696 | Fair. You’re below average and less viable for credit. |

| 529-650 | Low. You may face difficulties when applying for credit. |

| 300-528 | Poor. Your credit applications will likely be affected. |

| No score | Your score couldn’t be generated due to insufficient information. |

Factors that make up a CTOS score:

- Payment history (45%) – This is perhaps the most important factor affecting your credit score, so it’s crucial that you pay your bills on time!

- Accounts owed (20%) – How much money you owe is another important factor. The less credit you use, the better. However, there’s a catch-22: if you owe nothing at all, it can also be difficult to get loans because lenders want to see that you’re responsible enough to pay them back.

- Length of credit history (7%) – How long you have been using credit is something lenders consider. A long history can be helpful, but you shouldn’t worry too much as long as you make payments on time.

- Credit mix (4%) – Having a mix of different types of credit, like credit cards, instalment loans, and mortgages, is also a factor, albeit a small one. You don’t need to worry too much about this.

- New credit (14%) – The final component looks at how many new accounts you have. Having too many new accounts recently may be a red flag to lenders, as people tend to open new accounts when they’re experiencing cash flow problems or taking on new debt.

What is CTOS Used For

CTOS is used for.

1. Loan application

In order to assess if you’re a reliable borrower, lenders like banks need to review your CTOS report, including your credit score, payment history, and any legal records, to determine if you’re fit to get the loan.

2. Mortgages

Buying a house is a huge purchase, which is why banks and property developers check your CTOS report and financial history to make sure you can afford a home loan.

3. Employee Screening

Interviewing for a job isn’t just about your performance, background, and capabilities. In some cases, employers also look beyond your resume and check your financial history to see if you’re good at managing money — and this is where the CTOS report comes in.

4. Tenant Screening

Yes, your landlords may use your CTOS report to see if you’re a trustworthy tenant. They check your payment habits and whether there are any legal disputes. These are key factors to determine if you’re a reliable tenant.

Now that we’ve given you the basics of what CTOS is, how to check your score, and what it’s used for, we know you have more questions. So, we’ll answer some of the burning FAQs that most people are curious about.

FAQ

What does CTOS mean?

So, what’s CTOS? Think of it as Malaysia’s main credit reporting service. It collects information from public sources and government agencies to create detailed credit reports for individuals and businesses. These reports, which include things like your payment history, legal issues, and business ownership, help lenders — like banks or companies decide if you’re trustworthy enough to be a borrower.

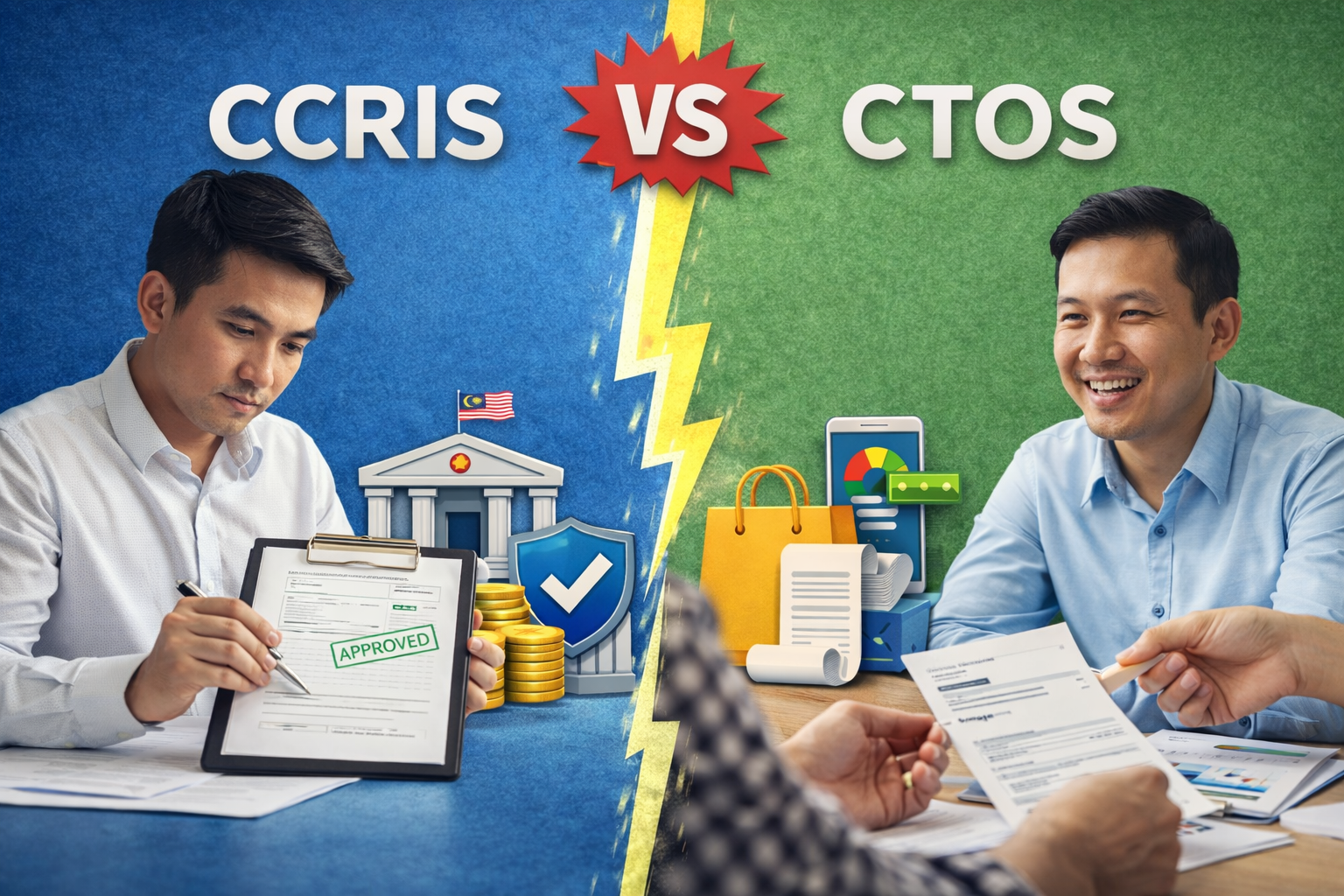

How is CTOS different from CCRIS?

The short answer is CTOS gives you a credit score, while CCRIS shows your borrowing history. It provides a record of your loans, repayment history, credit applications, and any flagged accounts. Think of it as a detailed log of everything you’ve borrowed and repaid.

Does CTOS blacklist people?

Don’t worry, CTOS doesn’t put anyone on a blacklist. What it does is collect credit information and present it to banks, companies, or other financial institutions.

Can I check the CTOS report for free?

Yes, you absolutely can! In fact, CTOS offers a free MyCTOS Basic Report, which gives you an overview of your financial status. However, if you want a more detailed report that includes your credit score, a fee applies.

What is a CTOS Score?

Your CTOS score is like your financial report card. It comes as a three-digit number (ranging from 300 to 850) to show how reliable you are with money. It’s calculated based on your credit history, payment patterns, debts, and any legal issues. Lenders, including banks, financial institutions, landlords, and even some employers, use this score to determine your financial health. The higher the score, the better you are with money!

At the end of the day, your CTOS report is more than just a number. By understanding your credit score, you can plan your finances better and increase your chances of getting loans approved. We hope this article has been helpful and that we’ve answered all your questions.