- Kuala Lumpur

Applying for a personal loan can feel overwhelming when faced with different bank requirements, changing approval criteria, and unfamiliar financial terms. Many borrowers are unsure where to begin, what documents are required, or how existing commitments may affect approval outcomes. AE Finansure provides professional personal loan consultant and advisory services to help Malaysians approach financing decisions with clarity and structure.

As an independent loan consultancy, AE Finansure supports individuals and business owners with personal loan advisory, debt restructuring guidance, business loan preparation, property refinancing advisory, and credit profile understanding. Our goal is to provide accurate information, structured guidance, and application support so clients can make informed financing decisions that match their financial position.

Whether you are applying for a personal loan for the first time, managing several loan commitments, or reviewing refinancing options, AE Finansure offers professional advisory support shaped around your circumstances and repayment capacity.

The Malaysian personal financing landscape features dozens of lenders, each with different eligibility criteria, documentation requirements, and approval processes. A professional loan consultant brings clarity to this complexity. Unlike bank representatives who promote their own products, independent consultants assess your complete financial situation and recommend solutions that genuinely fit your needs.

AE Finansure’s consultancy services begin with understanding your goals. Are you consolidating high-interest debts? Planning a major purchase? Managing cash flow for your small business? Our advisors analyse your income, existing commitments, and credit profile to identify realistic options. This personalised approach means you avoid wasting time on applications likely to be rejected, and instead focus on lenders where you have strong approval odds.

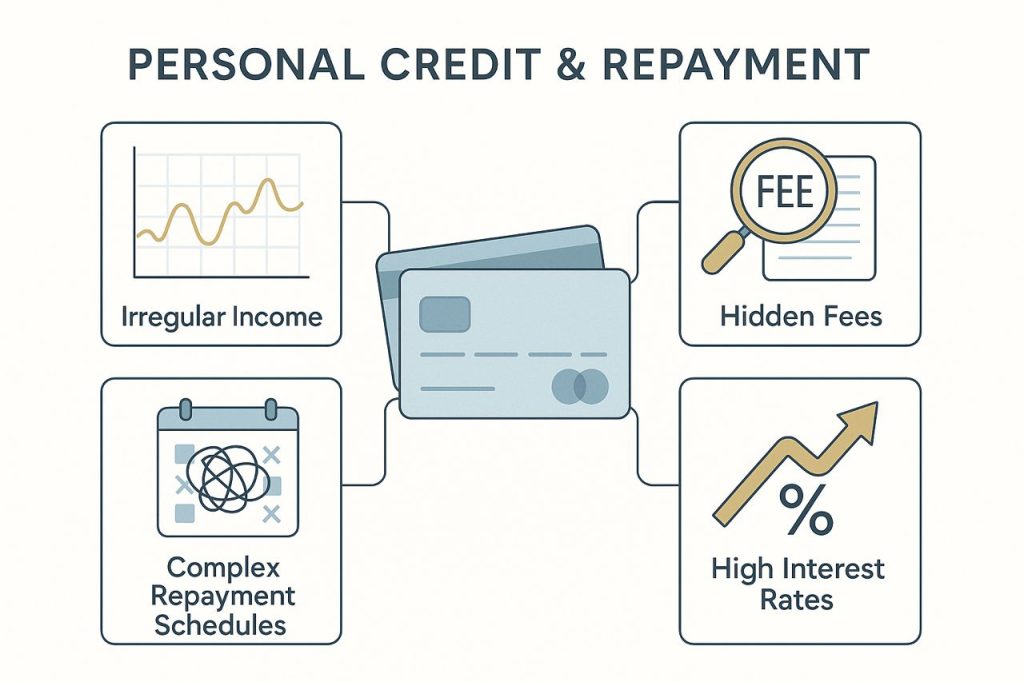

Working with a loan consultant also means having someone who speaks both your and the bank’s language. Financial institutions use technical terminology that can confuse borrowers, where terms like debt service ratio, lock-in periods, and early settlement penalties all impact your loan’s true cost. Our consultants translate these concepts into plain language, ensuring you understand precisely what you’re agreeing to before signing any documents.

The value also extends beyond the initial application. AE Finansure provides ongoing support, monitoring your loan status, liaising with banks on your behalf, and troubleshooting issues that arise during processing. If lenders request additional documentation or clarification, we handle these communications promptly. This reduces the stress and uncertainty that typically accompanies personal loan applications.

Personal financing serves multiple purposes. Some borrowers need funds for education, medical expenses, or home renovations. Others use personal loans to consolidate credit card debts or finance business opportunities. Each situation demands a different approach.

Conventional personal loans offer fixed monthly instalments over set periods, typically ranging from one to seven years. These work well when you need a specific amount for a defined purpose and can commit to regular repayments. Banks assess your eligibility based on factors including monthly income, existing debt obligations, and credit history. The challenge lies in navigating varying approval criteria across different institutions.

For those managing multiple debts, debt consolidation represents a strategic option. This involves combining several loans or credit card balances into a single facility, often with lower overall interest rates and simplified repayment schedules. However, successful consolidation requires careful analysis. Not every consolidation offer actually saves money once you account for fees, extended tenure, and total interest paid. AE Finansure’s consultants perform these calculations, presenting clear comparisons so you can make informed decisions.

Small business owners face additional considerations. While personal loans can fund business needs, dedicated SME financing may offer better terms for commercial purposes. Our advisors evaluate both personal and business financing routes, considering factors like tax implications, repayment flexibility, and how the debt appears on your credit report. This holistic view ensures you choose the most appropriate financing structure.

Refinancing becomes relevant when your financial circumstances improve or when better market rates become available. Switching from a higher-rate facility to a more competitive option can generate significant savings. However, refinancing involves costs such as early settlement penalties and new processing fees. Our loan consultancy services include detailed refinancing analysis, helping you determine whether switching lenders makes financial sense in your specific situation.

Successful personal loan applications depend on preparation and presentation. Banks want confidence that you can repay borrowed funds reliably, which means demonstrating stable income, manageable existing commitments, and responsible credit behaviour. AE Finansure’s consultants help you build a strong application that addresses lender concerns proactively.

Documentation forms the foundation of any loan application. Basic requirements typically include identity cards, recent payslips or bank statements, and EPF statements. Self-employed applicants need additional documents like business registration certificates, financial statements, and tax submissions. Missing or incorrect documentation causes most application delays. Our advisory services include thorough document reviews, ensuring everything is complete and accurate before submission.

Your debt service ratio matters significantly. This calculation compares your monthly debt obligations against your monthly income. Most Malaysian banks prefer ratios below 60%, though specific thresholds vary by institution. If your existing commitments push this ratio too high, we help identify strategies to improve it, whether through debt consolidation, increasing income documentation, or timing your application strategically.

Credit reports reveal your borrowing history to lenders. Late payments, defaults, or high credit utilisation negatively impact approval chances. Many Malaysians remain unaware of issues in their credit reports until applications get rejected. AE Finansure encourages clients to review their credit reports early in the consultancy process. If we identify problems, we can advise on correction steps or recommend lenders who may still consider your application despite past challenges.

Different banks target different borrower profiles. Some specialise in serving high-income professionals, while others focus on middle-income segments. Certain lenders are more accommodating toward self-employed applicants or those with shorter employment histories. As independent consultants working with multiple licensed financial institutions, we direct your application to lenders whose criteria align best with your profile, maximising approval probability while securing competitive rates.

Managing multiple debts creates both financial and emotional strain. Juggling various payment dates, interest rates, and minimum amounts becomes overwhelming. Missed payments damage your credit score, triggering penalty fees and higher future borrowing costs. Effective debt management requires strategy, not just willpower.

Debt consolidation addresses this by combining several obligations into one facility. Instead of tracking four or five separate payments monthly, you make a single repayment. This simplification reduces the risk of missed payments and often secures lower blended interest rates. The psychological benefit matters too. Managing one loan feels more controllable than managing many, reducing financial anxiety.

However, consolidation isn’t automatically beneficial. Extending your repayment period lowers monthly instalments but may increase total interest paid over the loan’s life. Some consolidation offers include hidden fees or unfavourable terms. AE Finansure’s consultancy approach involves calculating the true cost of consolidation versus maintaining separate loans. We present scenarios clearly, showing exactly how much you’d save or spend under different options.

Debt restructuring goes further than simple consolidation. This involves negotiating with lenders to modify existing loan terms, potentially reducing interest rates, extending repayment periods, or adjusting monthly instalments to match your current financial capacity. Restructuring becomes particularly relevant when circumstances change unexpectedly, such as income reduction or unexpected expenses creating repayment difficulties.

Banks prefer restructuring over defaults because it increases their chances of recovering funds. However, approaching lenders for restructuring requires careful handling. You need to present a realistic repayment proposal that demonstrates commitment while requesting terms you can actually maintain. Our loan consultants assist in preparing restructuring proposals, leveraging our understanding of bank policies and negotiation experience to secure arrangements that protect your credit standing while easing immediate financial pressure.

For small business owners, separating personal and business debts becomes important during restructuring. Mixing personal credit with business financing complicates matters if the business faces difficulties. Our advisors help untangle these situations, working toward solutions that safeguard your personal financial health even if business circumstances require adjustments.

Your credit history influences not just loan approvals but also the interest rates and terms you’re offered. Borrowers with strong credit profiles access better deals, while those with problematic histories face rejections or premium rates. Improving your credit standing takes time but delivers lasting benefits.

Payment consistency matters most. Banks track whether you pay obligations on time, every time. Even small delays get recorded. If your credit report shows frequent late payments, lenders view you as high-risk regardless of your current income level. The solution involves establishing consistent payment patterns moving forward. Setting up automatic payments or payment reminders helps prevent accidental delays.

Credit utilisation affects scores significantly. This refers to how much of your available credit you’re actually using. Maxing out credit cards or maintaining high balances relative to limits signals financial stress to lenders. Ideally, keep utilisation below 30% of available limits. If current balances sit higher, paying down these amounts before applying for new financing improves your profile considerably.

Credit report errors occur more frequently than many realise. Payments incorrectly marked as late, debts belonging to other individuals with similar names, or outdated information that should have been removed can all damage your score unfairly. Checking your credit report regularly allows you to identify and dispute inaccuracies. AE Finansure guides clients through this process, helping prepare dispute documentation and follow up with credit reporting agencies.

The number and timing of credit applications matter too. Multiple loan applications within short periods suggest financial desperation to lenders. Each application triggers a hard inquiry on your credit report, and numerous recent inquiries lower your score. This creates a challenging situation where applying broadly hoping for approval actually reduces your chances everywhere. Our consultancy services prevent this problem by targeting your application strategically to suitable lenders from the start.

Building credit when you have limited history requires patience. Secured credit products, becoming an authorised user on someone else’s account, or starting with smaller credit facilities can help establish positive records. Our advisors recommend appropriate credit-building strategies based on your specific situation, helping you develop the history needed for larger financing approvals later.

Personal financing needs vary widely between individuals and small business owners, though both groups benefit from professional consultancy services. AE Finansure serves both segments, understanding the distinct challenges each faces.

Individual borrowers typically seek personal loans for life events or debt management. Education financing, medical expenses, home improvements, weddings, or consolidating high-interest debts represent common needs. The challenges often involve meeting income requirements, managing debt ratios, or overcoming past credit issues. Our advisors help individuals present their applications in the strongest possible light, highlighting stable employment, demonstrating responsible credit behaviour, and choosing lenders whose criteria match their profiles.

For retirees or those approaching retirement, financing challenges differ. Fixed incomes and shorter loan tenures available at older ages complicate borrowing. Some banks impose age limits or require loans to be fully repaid by specific ages. We help clients in these circumstances identify lenders with more flexible age policies and structure applications emphasising savings, assets, or co-borrower arrangements that address lender concerns.

Small business owners face layered complexity. They often need financing for both personal needs and business operations, and these categories can overlap. Using personal credit to fund business expenses is common, especially in early business stages. However, this approach creates risks. If the business struggles, personal assets and credit become vulnerable.

Our consultancy services for SME owners include evaluating whether personal loans or dedicated business financing better suits their needs. Business loans may offer larger amounts, longer tenures, or more flexible repayment structures aligned with business cash flow. However, they typically require more extensive documentation and may need collateral. Personal loans are often faster to obtain but come with limitations on amounts and uses.

Cash flow management represents another distinct challenge for business owners. Unlike salaried individuals with predictable monthly income, businesses experience fluctuating revenues. This makes fixed monthly loan repayments challenging during slower periods. We help business clients structure financing that accommodates these fluctuations, whether through facilities with flexible repayment options or by timing applications during strong revenue periods to demonstrate capacity.

Tax considerations also differ between personal and business borrowing. Interest on business loans may be tax-deductible, while personal loan interest typically isn’t. Our advisors factor these elements into recommendations, sometimes working alongside clients’ accountants to identify the most tax-efficient financing approach.

Independence defines our consultancy approach. AE Finansure maintains no affiliations with specific banks or lenders. We don’t earn commissions by steering clients toward particular products. This independence means our recommendations stem purely from what works best for your situation, not from sales targets or lender relationships.

Our advisors bring extensive experience across Malaysia’s personal financing sector. We understand current bank policies, approval trends, and competitive rate environments. This knowledge base allows us to provide realistic assessments of your options. Rather than encouraging unrealistic expectations, we present honest evaluations of what you can likely achieve given your circumstances, then work to maximise those outcomes.

Transparency guides every interaction. We explain our recommendations clearly, walking through the reasoning behind each suggestion. If we identify challenges in your application, we discuss these openly rather than hiding difficulties. This honesty might feel uncomfortable initially but prevents wasted time pursuing unviable options. It also builds the trust needed for effective long-term financial guidance.

Our consultancy services extend beyond single transactions. Many clients return when circumstances change, whether seeking to refinance at better rates, needing additional financing for new goals, or facing unexpected financial challenges requiring restructuring. These ongoing relationships allow us to understand your evolving needs and provide continuity in financial guidance.

AE Finansure operates with the understanding that personal financing decisions impact lives significantly. Taking on debt represents serious commitment. We approach each consultation recognising this importance, providing the thoroughness and care your financial decisions deserve. Our goal isn’t simply completing applications but ensuring you secure financing that genuinely serves your interests and remains manageable throughout its term.

Ready to navigate your personal financing needs with professional guidance? Contact AE Finansure today for a complimentary consultation. Our loan consultants will review your situation, discuss your goals, and outline realistic options available to you. Whether you need immediate financing, want to consolidate existing debts, or simply wish to understand your options better, we’re here to provide honest, expert advice. Take control of your financial future with a trusted advisor supporting your journey.

A financial advisor helps individuals and businesses make informed decisions about their finances, offering guidance on investments, retirement planning, tax strategies.

A personal loan consultant is an independent financial advisor who helps individuals and businesses navigate the loan application process. At AE Finansure, our consultants assess your financial situation, recommend suitable lenders, prepare documentation, and guide you through approval. Unlike bank representatives who promote their own products, we work independently to find solutions that match your specific needs across multiple licensed institutions.

Loan consultants provide end-to-end support for securing personal financing. Services include financial assessment, credit profile review, documentation preparation, lender selection, application submission, progress monitoring, and post-approval guidance. We also assist with debt consolidation planning, refinancing analysis, and restructuring negotiations. Our role is ensuring you understand all options, avoid common pitfalls, and secure the most appropriate financing for your circumstances.

Financial advisor fees vary based on services provided. Some charge hourly rates, others work on retainer, and some earn commissions from financial products. At AE Finansure, we offer transparent consultancy with no hidden fees. Initial consultations are complimentary, allowing you to understand our services before committing. Contact us directly to discuss your specific needs and our fee structure.

We believe in transparent pricing. Our initial consultation is free, giving you the opportunity to discuss your needs and understand how we can help. For ongoing consultancy services, we explain all fees upfront before you engage our services. There are no hidden charges or commissions from lenders influencing our recommendations.

Yes. We regularly assist clients with challenging credit histories. Our approach involves reviewing your credit report, identifying specific issues affecting approvals, and developing strategies to address them. This might include credit repair steps, targeting lenders with more flexible criteria, or structuring applications that highlight your strengths. While we can’t guarantee approval, our experience helps clients with difficult profiles secure financing they couldn’t obtain alone.

Timelines vary by lender and application complexity. Simple applications with complete documentation may receive approval within a few days, while more complex cases involving multiple income sources or credit issues may take several weeks. AE Finansure accelerates the process by ensuring documentation is correct from the start, selecting appropriate lenders, and monitoring progress actively to address issues quickly.

No. AE Finansure operates independently without affiliations to specific financial institutions. This independence is fundamental to our consultancy model. We evaluate options across multiple licensed banks and lenders objectively, recommending solutions based solely on what serves your interests best. This unbiased approach distinguishes us from bank representatives or tied agents.

Absolutely. We serve both individual borrowers and small business owners. Our consultants understand the distinct requirements of personal versus business financing and can help you determine which type best suits your needs. For business owners, we often evaluate both options, considering factors like amounts needed, tax implications, and how the debt affects personal versus business credit profiles.

WhatsApp us